Looking for a quick, easy way to earn cash?

Oops, I’m sorry. I meant to say learn cash—as in money lessons!

Today, we’re diving into a topic that’s always a hot commodity: money. Although we may be living in an increasingly cashless society, teaching kiddos about money is still critical for their success both inside the classroom and out. Well-structured money lessons prepare students for a world where decimals, number sense, and place value reign supreme, and it also equips them with valuable life skills!

We all know that money talks, so let’s get our financial game faces on and explore how to make money lessons both engaging and tailored to our students’ diverse needs. First, though, let’s take a look at the real money-maker in our classrooms that are sure to make these money lessons effective: differentiation.

The Need for Differentiation: A Quick Recap

Before we jump into the practical strategies and activities to make your money lessons worth their weight in gold, let’s talk about the why behind differentiation. In a previous post, I broke down just what differentiation is in order to establish a strong foundation.

Let’s take a closer look at the concept of student diversity. As I’m sure you’ve discovered, students are as unique as the serial number on a dollar bill! Each individual kiddo has their own prior knowledge, learning styles, and abilities, so it’s not always helpful to approach teaching with a one-size-fits-all lesson plan.

For instance, picture this: you’ve got Susie, a visual learner, and Johnny, who’s a hands-on kinesthetic learner. Then there’s Tim, who somehow already knows how to calculate compound interest, and Lisa, who’s just starting to get the hang of counting pennies. Some kiddos benefit from slideshows and presentations, while others will receive clarity from manipulatives. With so much variety, planning your money lessons can feel overwhelming.

But fret not! This is where differentiated instruction sweeps in to brighten your day, like a spare $20 bill on the ground. It’s like a superhero cape for teachers. Differentiation makes your money lessons tailored to your students’ individual needs, improving engagement, understanding, and overall learning. Differentiation is like investment, except we’re investing in your kiddos’ long-term success!

Now, let’s delve into the practical strategies and activities we can use with money lessons to make it all happen.

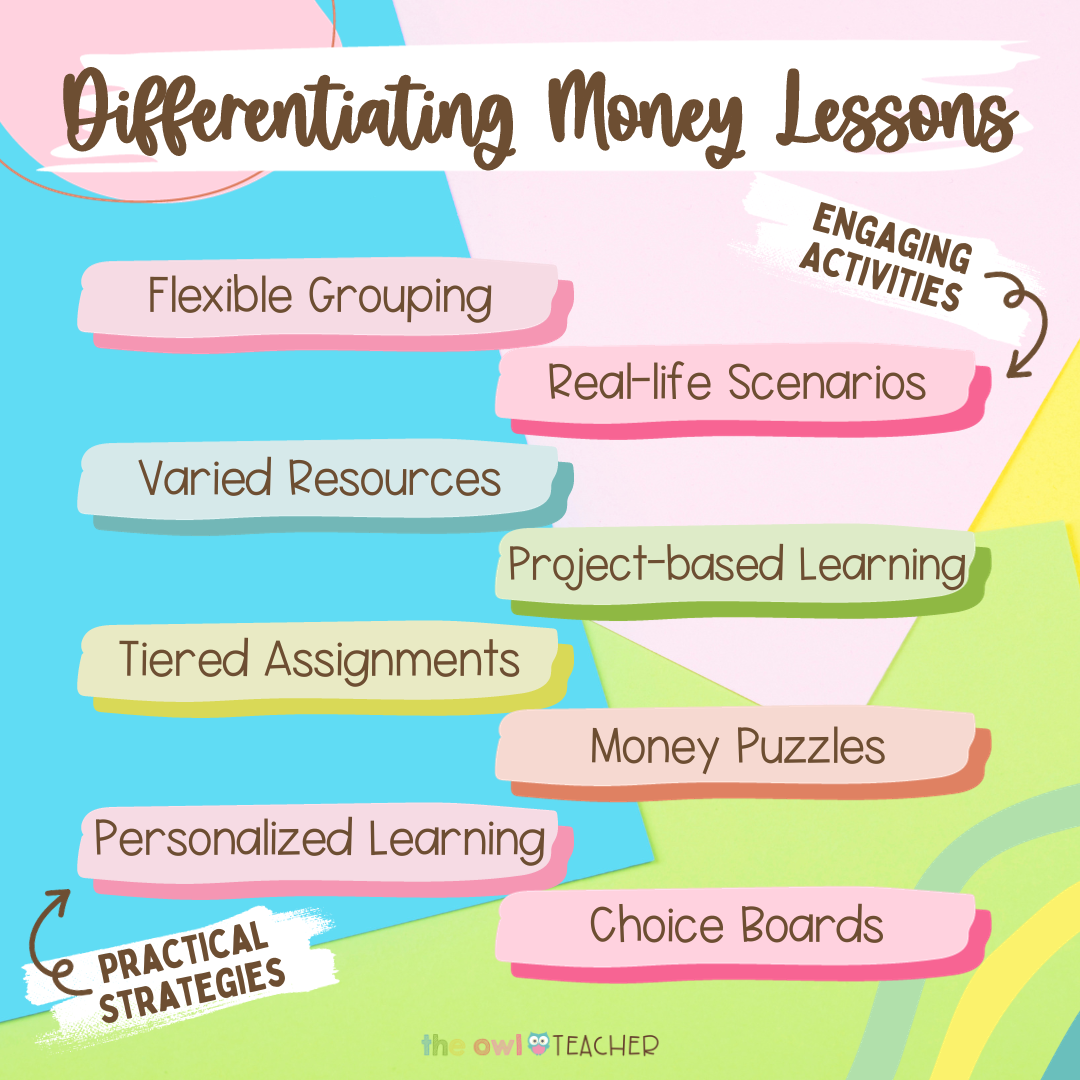

Practical Strategies: Money Talks… with a Twist!

Let’s kick these money lessons off with a few practical strategies that’ll make your classroom ready to buy more!

First and foremost, I love to group students up. In fact, I even discussed eight different ways to group students up in a previous blog post! Encouraging students to work together develops crucial cooperation and teamwork skills as well as allowing student-led inquiry. For these money lessons, however, I recommend using flexible grouping.

Flexible grouping is like assembling a dynamic dream team. In essence, flexible grouping is like matchmaking, but for learning! In order to effectively group your kiddos for money lessons, take inventory of their specific needs and abilities. If Susie and Johnny both learn best with hands-on activities, then they should be grouped together and given the resources to optimize their learning. Similarly, if Tim and Lisa already have the basics down pat, then group them up with other students who are ready to dive into more advanced challenges.

In the same vein, be sure to use varied materials and resources in order to capitalize on the wealth of knowledge. Spice things up in your classroom! Use a mix of visual aids, manipulatives, and technology. Visual learners can dance with money charts, while kinesthetic learners can get their hands on money flashcards and interactive apps.

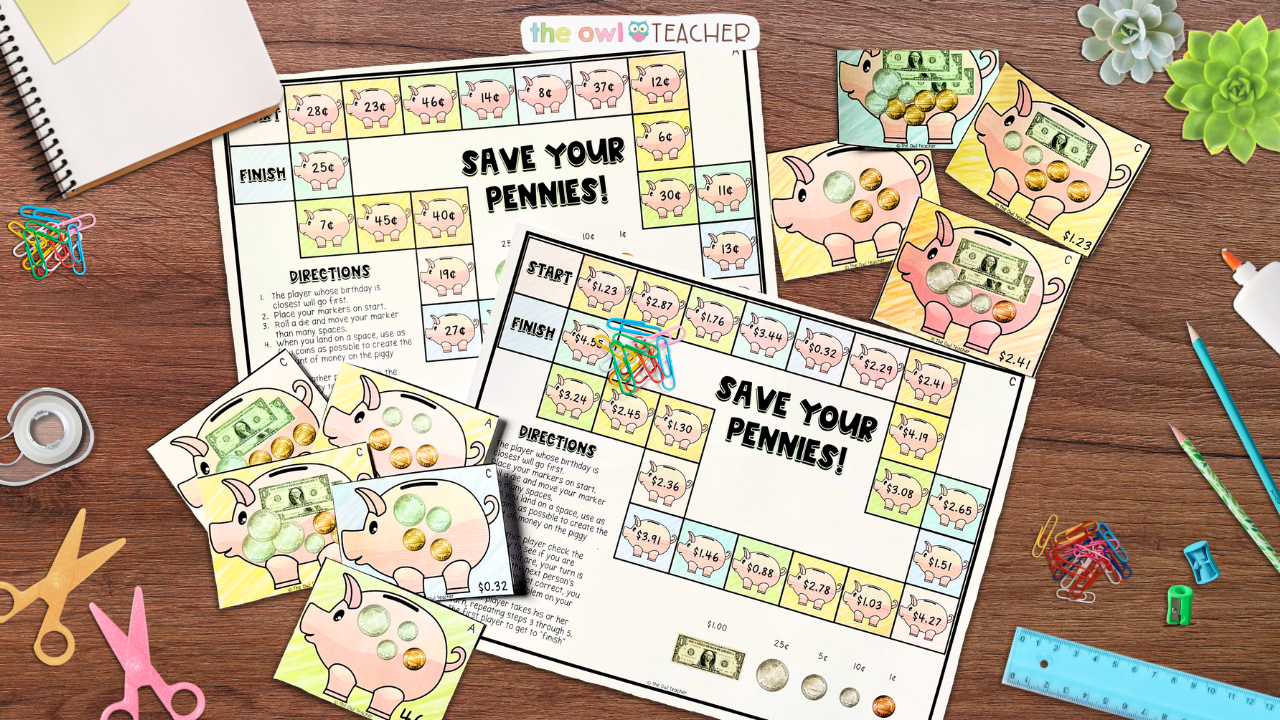

Personally, I have several different resources available to put some extra oomph in your money lessons, such as my coin-counting money game, my start-to-finish money puzzle, and my digital boom cards. All three resources cover the concept of money while presenting information in a variety of ways to differentiate for your kiddos. It’s a money extravaganza for everyone!

Along with flexible grouping and varied materials, engage your students with tiered assignments. It’s like a three-tiered cake of money mastery! Tiered assignments offer different levels of complexity. Essentially, all students have the same end goal (in this case, understanding money) but the specific tasks assigned should provide different levels of challenges appropriate to students’ abilities. For instance, one student may tackle counting coins while another adds and subtracts, all while Tim and Lisa are busy delving into the intricate art of making change. It’s like a cash grab of learning!

Finally, the last practical strategy to use with your money lessons is personalized learning paths. They’re like a GPS for individualized learning! Here, you can utilize assessment results to keep an eye on your kiddos’ progress and adjust the challenge level of tasks as needed. Keep in mind, too, that “assessments” doesn’t always mean tests—there are a plethora of informal assessments out there!

Engaging Activities: Money Lessons Unleashed

Now, let’s make learning about money as exciting as finding a dollar bill in your coat pocket! Let’s take a peek at some engaging activities to differentiate and spice up your money lessons in a more hands-on way.

First and foremost, take a few moments before your lesson begins and brainstorm as many real-life scenarios as you can that involve money. Chances are, you’ll run out of room on your paper! Pick a few examples that you think will stand out the best to your students, then bring the real world into the classroom. Challenge students to apply their financial wisdom! Maybe Susie runs a lemonade stand while Johnny goes grocery shopping. Meanwhile, Tim and Lisa are investing in a virtual stock market!

In addition, take a look around the Internet for money-themed project-based learning. Money makes the world go round, so why not make it the center of your projects? Explain the importance of money in your classroom, then provide a relevant PBL resource and allow students to explore at their own pace. Susie might budget for her dream vacation, Johnny invests in a fictional company, Tim explores stock portfolios, and Lisa plans her weekly allowance. Money, meet creativity!

And, like I mentioned above, money puzzles are always a hit in the classroom, especially when it comes to money lessons. Who doesn’t love puzzle time? Coin-themed crosswords, money jigsaw puzzles, riddles, or even Sudoku games are all on the menu. Or check out my Start2Finish puzzles!

If you can’t decide what to do, no worries: use a choice board! It’s like a buffet of activities for your money lessons, from money art projects to real-life money scenarios, or financial literacy games and even online money simulations. There’s always time to work on those technology skills, after all! Overall, remember to provide a variety of choices that fit the individual needs in your classroom. Besides, giving students the choice is a sure way to encourage engagement and boost morale.

Ultimately, differentiating money lessons is your ticket to success in the classroom. Meeting the diverse needs of your students doesn’t have to be a Herculean task, either—embrace flexible grouping, harness varied materials, use tiered assignments, and create personalized learning paths to succeed! And when it comes to engaging activities, let real-life money scenarios, money PBL, money puzzles, and choice boards be your trusty sidekicks.

As you embark on this monetary adventure, remember the importance of differentiating money lessons to cater to the diverse student needs. And don’t forget to explore my supplementary teaching resources designed to help you save time and enhance your money lessons. Together, we’ll make financial literacy a blast and prepare your students for a world where dollars and cents make sense!

In order to invest in the future, you and I can embark on a mission to make learning about money fun, engaging, and tailored to your students. Let’s keep those innovative teaching methods flowing and empower your diverse learners to master the art of money management. Until next time, keep the change and the smiles!